What's the AEO?

Senior Certification Enterprise

access toGreen Channel of

Customs Declaration

AEO (Authorized Economic Operator): is defined as: "Either party in any way participate in the international circulation of goods, and is recognized by customs authorities according the security standard of the world customs organization or equivalent supply chain, including producers, importers, exporters, customs broker, shippers, tallyman, middlemen, port and airport Operator, cargo terminal operators, warehousing operators and distributors". according《the global trade security and facilitation standards framework》enacted by the world customs organization (WCO)

Common Enterpise

vs

AEO Enterprise

Zhongzhou Group AA

Enterprise Introduction

- AA Enterprise ( also know as AEO Senior Certification Enterprise)

- Access to the most convenient policy of chinese customs

- Access to the convinient measures of the customs clearance provided by national or regional customs from the AEO mutual recognized coutnries or regions.

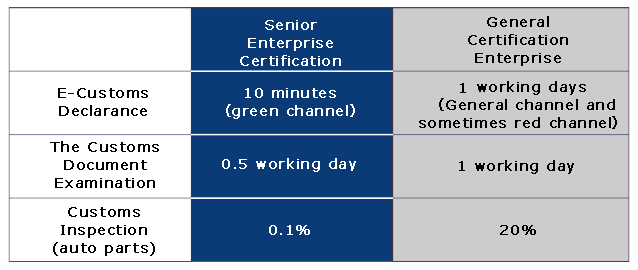

- The average inspection rate of the customs clearance can be reduced 90% for AEO enterprise compared with common enterprise, and the timeliness of customs clearance can increased more than 90% by simplified procedure of green channel.

Six Advantages of AEO

AA enterprise can supply the best efficient customs clearance service to the consignee.

Zhongzhou was authorized “ AEO certification enterprise” by China's General Administration of Customs, which means that Zhongzhou’s reputation and past performance are good on abidance by law, credit statement and security.

- low probability of Customs inspection

- Access to Green channel of customs declaration

- Access to the policy of “ release ahead of duty” to dutiable goods.

- Access to the Simplified procedures of documents examination

- Access to the policy of “ tax collection of total amounts” ,which can decrease the cost ofenterprise funds management

- Access to Customs coordinator specialized for AEO enterprise.